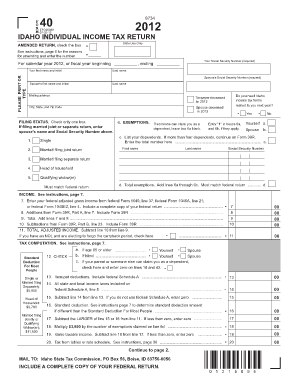

2012 Idaho Guide To Income Tax Withholding

May 2, 2018 2018-0929 Idaho 2018 revised withholding tax tables are effective immediately, special requirements apply to Form W-4 The Idaho State Tax Commission has released to its website revised (rev. 4-27-2018), containing updated 2018 state income tax withholding tables adjusted for inflation and reflecting a reduction in the income tax rates. The supplemental withholding rate is reduced to 6.925% (down from 7.4%). The tax commission also changed the method for claiming state allowances on the federal Form W-4. Under recent legislation, personal and dependent exemptions have been eliminated and most itemized deductions have been eliminated or capped. Starting with tax year 2018, the Idaho withholding allowances used in the percentage computation method are the number of children who qualify for the new Idaho Child Tax Credit. This number is reported on line 5 of the Form W-4 following the federal allowances.

Although the revised 2018 withholding tables reflect significant retroactive changes due to new federal and state tax laws, employers are instructed to not adjust the withholding for the months prior to receiving the revised tables, but instead to begin withholding under the new tables now. (, Idaho State Tax Commission, May 1, 2018.

The Idaho personal income tax schedules are adjusted for inflation each year. The Commission releases revised income tax withholding tables when the accumulated annual inflation adjustments cause a substantial change.? Supplemental wages The supplemental withholding rate is reduced to 6.925% (down from 7.4%).

Supplemental wages are those wages paid to an employee in addition to the employee's regular wages, such as bonuses, commissions, overtime pay, payments for accumulated sick leave, severance pay, awards, prizes, back pay, retroactive pay, expense allowances paid under a nonaccountable plan, payments for nondeductible moving expenses and other similar payments. Employers may choose to compute withholding on supplemental wages by combining the supplemental payment with regular wages and treating them as a single payment or by multiplying the supplemental payment by the supplemental withholding rate. Changes made in use of federal Form W-4 for state withholding purposes The Commission recommends that all employees update their federal Forms W-4 for state withholding purposes. Idaho does not currently have a separate state Form W-4. Idaho recently passed legislation? to conform to the federal Internal Revenue Code for tax year 2018.

The law includes additional tax breaks and a new child tax credit. Individuals will see significant changes to the Idaho income tax return starting with their 2018 state personal income tax return. Idaho now uses an Idaho allowance count on the federal W-4, line 5 (see the example on pages 19 of the revised withholding tax guide) to calculate withholding. The Idaho withholding allowances are based on the number of children who qualify for the Idaho Child Tax Credit. Prior to tax reform, Idaho withholding calculations were based on the federal Form W-4 that collected the employee's filing status and number of exemptions. Idaho's 2018 withholding table calculations use the filing status, number of qualifying children, and tax bracket information.

The Commission makes the following points concerning the Form W-4 for Idaho withholding: — Using the federal allowance entry reported on the 2018 Form W-4 could cause miscalculations of Idaho income tax withholding. — The Commission will use the federal Form W-4 for tax year 2018 and will require a state-specific entry on line 5. — In addition to the number of federal allowances, Idaho taxpayers will determine the number of qualifying children and insert that number on line 5 of the federal W-4 after the federal number (the state entry reports only the number of qualifying children for the new child tax credit, which differs from the federal calculation). To ensure proper withholding, the state entry is important for the employer to collect.

2012 Idaho Guide To Income Tax Withholding 2018

The Commission will consider releasing a state specific Form W-4 for the 2019 tax year; with the decision to be made by September 2018. See the agency's for more information.

1989 buick lesabre for sale. CHILTON 28240 Total Car Care Manual - GM: Full-size Buick, Olds & Pontiac, 1975-1990 Info One of our most popular parts. (Only 2 Remaining).

Changes for tax year 2018 under HB 463 are the changes provided for under HB 463: Indiv idual income tax return changes The individual income tax rate has been reduced by 0.475%. The top rate for individuals is now 6.925%.

The standard deductions have increased: — Single = $12,000 — Head of Household = $18,000 — Married Filing Jointly = $24,000 Personal and dependent exemptions have been eliminated. Most itemized deductions have been eliminated or capped.

Qualifying expenses from a 529 Education Savings account now include K-12 and private schools. Idaho has a new nonrefundable Idaho child tax credit of $205 for each qualifying child. Bus iness income tax return changes — Miscellaneous business income tax changes are adopted (see the agency's??for details). — The corporate income tax rate has been reduced by 0.475%. The top rate for corporations is now 6.925%.

For more information about the Idaho tax law changes for 2017 and 2018, read? For more information on Idaho withholding taxes, see the agency's ——————————————— Contact Information For additional information concerning this Alert, please contact: Employment Tax Services Group. Debera Salam ——————————————— Other Contacts Employment Tax Services Group. Kenneth Hausser. Kristie Lowery. Debbie Spyker ——————————————— ATTACHMENT EY Payroll News Flash.

The information contained herein is general in nature and is not intended, and should not be construed, as legal, accounting or tax advice or opinion provided by Ernst & Young LLP to the reader. The reader also is cautioned that this material may not be applicable to, or suitable for, the reader's specific circumstances or needs, and may require consideration of non-tax and other tax factors if any action is to be contemplated. The reader should contact his or her Ernst & Young LLP or other tax professional prior to taking any action based upon this information. Ernst & Young LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein. Copyright © 1996 – 2018, Ernst & Young LLP All rights reserved.

No part of this document may be reproduced, retransmitted or otherwise redistributed in any form or by any means, electronic or mechanical, including by photocopying, facsimile transmission, recording, rekeying, or using any information storage and retrieval system, without written permission from Ernst & Young LLP.